Many of the popular real estate crowd funding platforms offer a fix and flip, short term loans as an investment opportunity. Usually these investments have duration of 6-12 months with interest only payments paid to investors. The loan is secured by the underlying property until the borrower repays the loan in full. After earning monthly interest on their investment, investors receive a balloon payment at the end of their principal. With these fix and flip or rehab real estate loans, investors pool their money to buy debt securities that are tied to the performance of a specific loan or pool of loans.

The important item to note is that this type of investment does NOT provide amortized return; you only receive interest payments with your principle returned at the end of the loan term period, hence the interest only payments. While interest rates and investor returns are high (11-12%) there are some real risks associated with such loans that investors should be aware of while chasing yields.

Borrower Risk

Purchase price and pressures:

Lured by the flip and profit infomercials, many get rich quick house flippers have entered the market under the assumption that they can make a quick return on their investments. The major profit in fix and flip is as the name suggests, the home purchase price must leave room for rehab costs and then an up sell to net a profit. The competition in the market however has led to increased bidding at auctions as the housing market recovers. This results in higher than distressed pricing which has reduced profit for house flippers.

Quality:

Unbeknownst to investors outside the industry, homes bought at auctions allow house flippers to perform exterior inspections of the property but rarely interior inspections (check out multitude of house flipper shows on HDTV – this is their dramatic cut scene) prior to the sale of the property. As you can imagine this may lead to inaccurate rehab costs.

Closing speed:

Sometimes due to delays in underwriting home loans, the closing date of the deal may be delayed which further dents the return rate for the house flipper.

ducks in row:

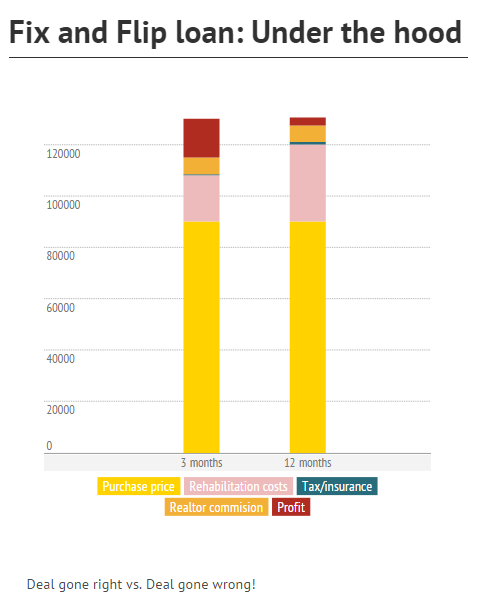

A quick example can demonstrate how events and actions need to be perfectly aligned to fix and flip the house in estimated short time. For example, in a feel good scenario, the buying price is 90K, with rehab costs of 18K. Together with insurance and tax of $450 and realtor commission of $6,500 the flipper makes ~$15,000 profit or 16.67% from his efforts if he were to sell the house for $130,000. A deal gone sour where the cost of rehab sky rockets to $30,000 only yields a return of 3.33% if every other expense from above is kept the same – yikes!

Investor/Lender risks:

For investors lending money to house flippers, you have to be mindful of the unique challenges the borrower is facing as described above. While lending to commercial or retail real estate vs. rehab loans may superficially seem like “all the same real estate lending”, fix and flip loans exposes investors to unique risks.

First and foremost the risk profile is different. When lending it is important to look at sources of income of the borrower. For example if there is a corner gas station and grocery store you lent money to has diversified income streams. It earns money from gasoline sales, grocery sales, possibly ATM fees, an inline cafeteria etc. An established commercial real estate such as a shopping center, generates monthly rental income. Fix and flip loan relies on the borrower personally paying monthly interest – there is no inherent “business” cashflow.

This means that if the rehab cannot be flipped, you have to wonder how the house flipper is going to continue to pay the loan (from his personal assets/income?). The property is not producing any income. This adds a serious risk factor to your lending portfolio.

We have seen this script before for years in the mortgage loan industry, some of the riskier loans are based predominantly on the foreclosure or liquidation value of borrower’s collateral rather than on borrower’s ability to repay the mortgage.

A more passionate discussion is happening HERE on these rehab loans where a house flipping deal fell through (Biggerpockets forum)