Picture is worth a 1000 words. Unfortunately for investors, there is not much to say when it comes to the volatility the public markets are having recently.

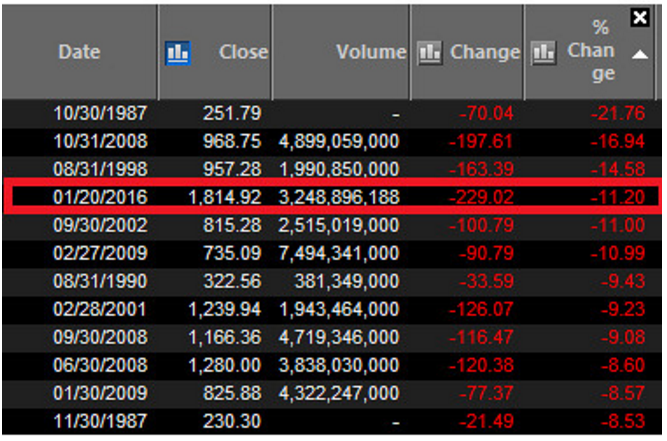

Including dividend returns the S&P 500 returned 1.19% in 2015. This year, 2016, its even worse. In fact it is the 4th worst month since 1987.

(source: Marketwatch)

And the Dow Jones? Down almost 15% from its recent bull high. Needs to fall 5% more to hit the Bear market. Yeesh.

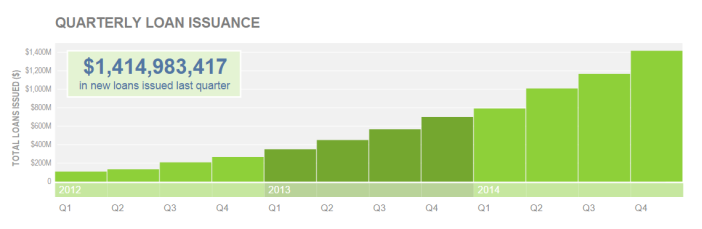

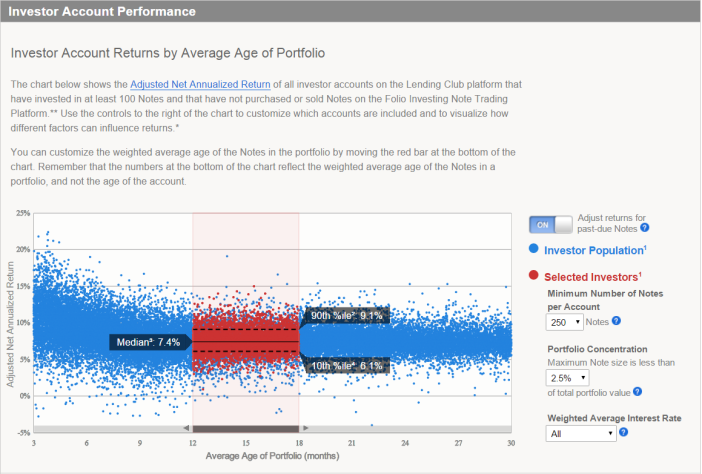

Contrasting this with the stable returns of, lets say LendingClub Marketplace:

You get a median return of 7.4% in a portfolio of 250 notes.

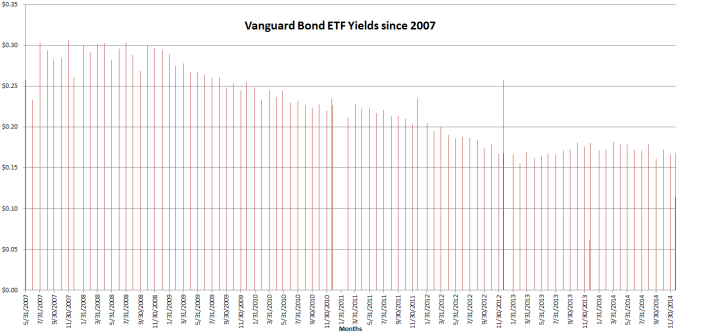

Stock market volatility is a reality and no one is endorsing a 100% investment in marketplace lending or real estate lending or business lending. What this highlights is the LOW volatility of this asset class. Volatility destroys wealth, as detailed in prior post.

You can plug and play around with CAGR (compound annual growth rate) of the S&P 500 HERE

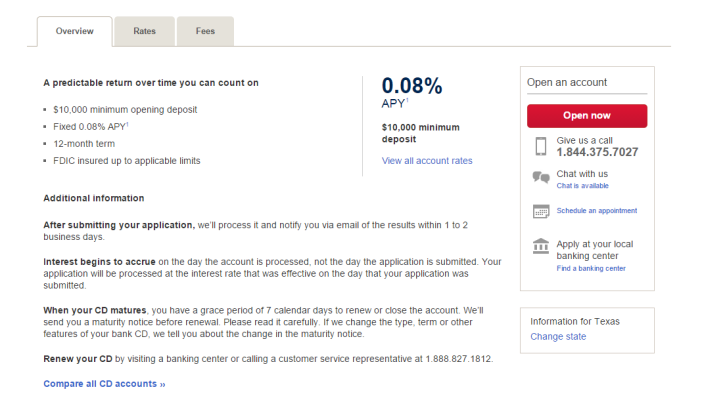

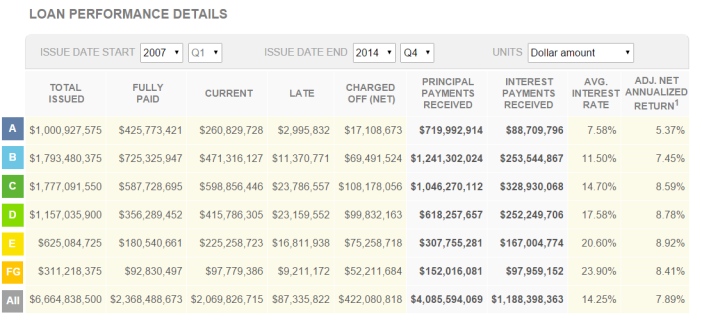

As a title II platform, Reamerge, or majority of other residential or commercial real estate platforms do not publish their return statistics online. However, if consumer lending returns are any indication, these platforms offer even more downside protection as they are usually asset backed while have uncorrelated strong returns in their niche markets.

It is certainly a good time to give these platforms a look be it business lending, real estate, consumer lending, mortgage lending. While there are no guarantees, a well diversified marketplace lending portfolio should provide good cash flow and low volatility.

You can read more extensive discussion of the stability of returns with analysis HERE in our previous post.