Previously we had a major post on different asset classes and where P2P lending fits in a well diversified portfolio. Today, we would do a statistical analysis of annualized returns of loans in P2P lending, specifically, those that are available on major platforms specializing in consumer debt financing namely Lending Club and Prosper.

Of the two major consumer debt marketplaces in the USA, Lending Club (LC) has received the majority of media attention sans successful IPO in December 2014. Due to the exposure, more so than ever, retail investors are looking at LC as a viable alternative to generate stable returns. Let us take a deeper look.

BOND RETURNS:

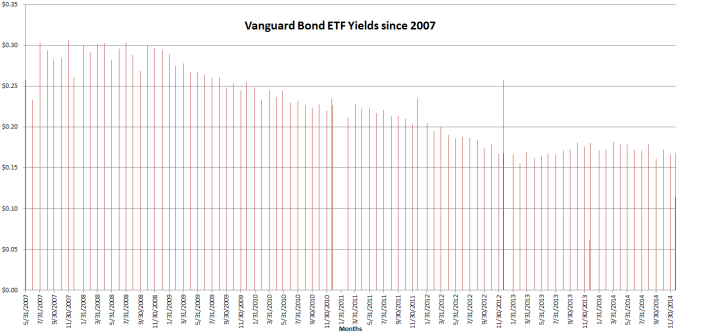

Let us evaluate BND (Vanguard Total Bond Market ETF) returns which we will take as a good estimation of the bond market in general. Since 5/2007 till 12/22/2014 BND payed a total dividend of $22.07 (see monthly returns graph below)

In these 2763 days, the Bond price it self has appreciated $8.91 (it increased from $73.84 to $82.75)

The Annual return is: (82.75 + 22.07)/(73.84)]^(365/2763) – 1 = 0.047 or 4.7%