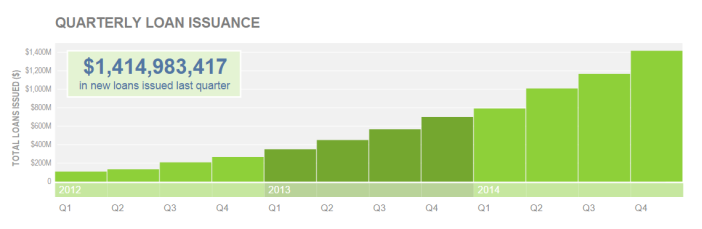

Peer to Peer Lending (P2P) continues to gain momentum thanks in part to platforms such as Prosper and LendingClub, the latter having launched a successful IPO driving further interest from investors. Looking at the loan volume just last quarter of 2014 for LendingClub over $1.4 billion of loans were issued (and growing).

These platforms are helping finance consumer debt however many other platforms exist using a similar methodology but in different vertical market, namely Real Estate. On a fundamental level both offer different types of returns and have different risk exposure but Real Estate platforms offer some advantages versus consumer loan platforms.

One of these advantages is offering secured debt. These Real Estate platforms offer debt obligations which are supported by first or second liens on the physical property. Liens benefit investors by allowing platforms to liquidate the property in the event of a default on obligations, providing a strong downside protection.

Reamerge is a fusion of the above mentioned concept – it is a marketplace financing business loans but securing it with assets tied to the business. In most cases this takes the form of the physical property the business operates out of along with any equipment that the business is using. Besides this obvious advantage there are a couple of other fundamental shifts that are happening in the larger P2P marketplace industry —

Balance Transfer:

It is no secret that the “peer” in peer to peer lending is getting squeezed out – to quote from a well written article by Nav Atwal at forbes.com here

Regardless of the merit of the arguments on both sides, one thing is for certain – the term “peer-to-peer” is no longer an accurate tagline for the industry. Rather, the peer lender is now the faceless institution with little motivation other than monetary return on investment. And what does this shift mean for the individual investor? Many argue that it means only the lowest quality loans will be allocated to the individual after institutions commence their feeding frenzy.

Looking beyond the growing disadvantage for the retail investor, let us focus on the type of debt available to investors on LC and Prosper. It is consumer debt. Majority of borrowers are refinancing their debt. The same holds true for SoFi, a company focusing on refinancing student debt.

Overall, this has a feel of balance transfer into amortizing loans. Money is exchanging hands here; from investors to borrowers, to back to the banks who issued credit card to the borrower. By contrast, most of the real estate debt platforms and the business lending platforms are lending for improvement of business, or house flipping etc. You can consider a stronger “value” creation in the economy as a mission underlying these non-consumer loans.

Seeking Alpha/or Lack thereof:

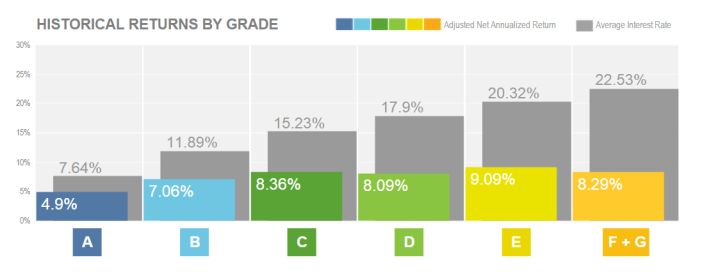

Flood of institutional money into major consumer debt platforms has created competition on the retail investor side which then leads to lower returns/alpha. Alpha in the sense that investors would want to minimize their risk and maximize returns in the form of buying/investing in A grade loans that perform and have returns that of B grade, or buying a B-grade loan with risk of a “B” but performance of a C grade loan. This appears to have been largely negated and we will address the returns year or year in another post with real data.

Collection process:

One of the biggest advantage of niche platforms like Reamerge is the collections process. In consumer debt platforms, the only way to collect on default is to pursue the borrower where the borrower ultimately may be unable to pay on the outstanding debt. With secured debt, the investment is backed by property or hard collateral which can be foreclosed or liquidated to recoup the investment. Additionally, there is personal guarantee from borrowers as well as additional guarantors to make up further repayments in an event of a short fall in default.

Take aways:

Marketplaces offering debt will continue to evolve and will have wide array of private debt available. It is important to understand secured vs unsecured debt, its historical performance in the wider economy, and be cognizant of the larger trends as the industry matures to take advantage of opportunities and risk adjusted returns.