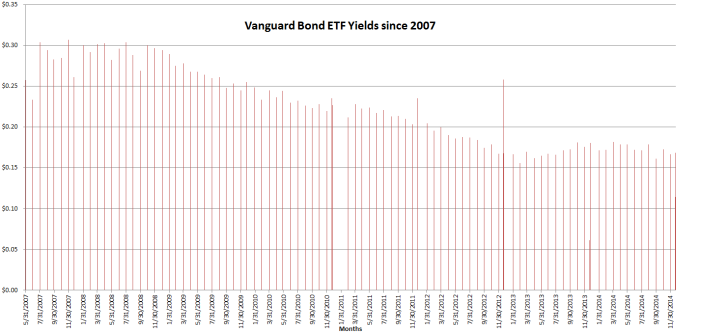

Previously we did a short statistical analysis of LendingClub loan investments that have matured and how they rated against a bond ETF. However, risk mitigation / control is one of the cornerstones of smart investing. Professional investors in P2P Lending space SHOULD be “boxing” risk instead of boxing investment products (student loans, consumer credit, business loans). In short, the Reamerge team are students of risk allocation rather than the asset allocation theory.

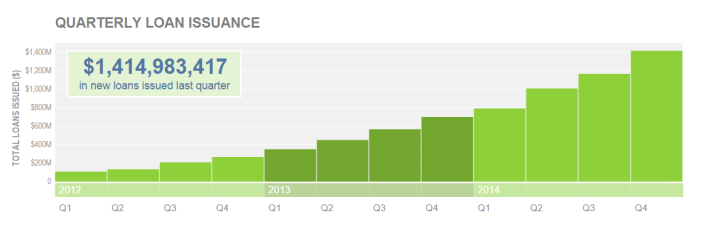

Today we will look at recent market volatility and how incorporation of P2P lending/Marketplace lending into a traditional investment portfolio significantly reduces one’s portfolio volatility. It should be noted that while niche platforms in real estate crowdfunding may correlate with housing markets, a unique platform like Reamerge that is the fusion of high quality business lending with collateral is further insulated from stock market crashes. They are also separate from consumer credit platforms such as LendingClub which is dependent on credit cycle and correlated to the larger economy. The purpose of using LendingClub as proxy for marketplace lending industry is their open data that can be readily analyzed and their market leader position. Most of the private crowdfunding platforms are private placement portals and deal details are prohibited under law (hopefully in the future this will change as SEC passes sweeping crowdfunding laws – at least we hope so!)

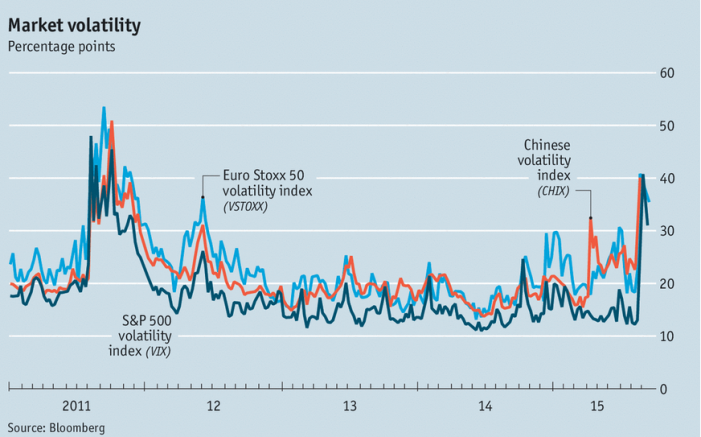

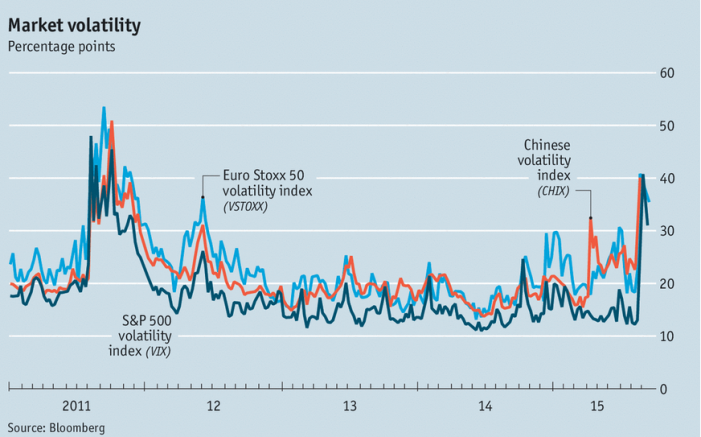

Market Volatility:

As we saw, Dow slid 1000 points last week and blue chip stocks such as GE dipping >20% for example. The CBOE volatility index, or VIX, is also known as the “fear index” jumped to its highest level since 2011. While pundits are correct in preaching to long term investors to not be worried, shouldn’t investors demand higher returns for all the volatility they have to stomach?

S&P 500 is negative year to date. Is this going to recover? No one knows how this year is going to play out. What remains factual is that currently there is market volatility that investors have to bear.

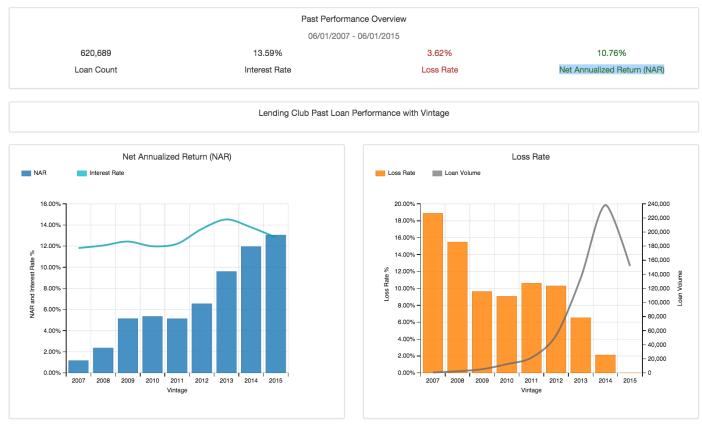

LendingClub returns:

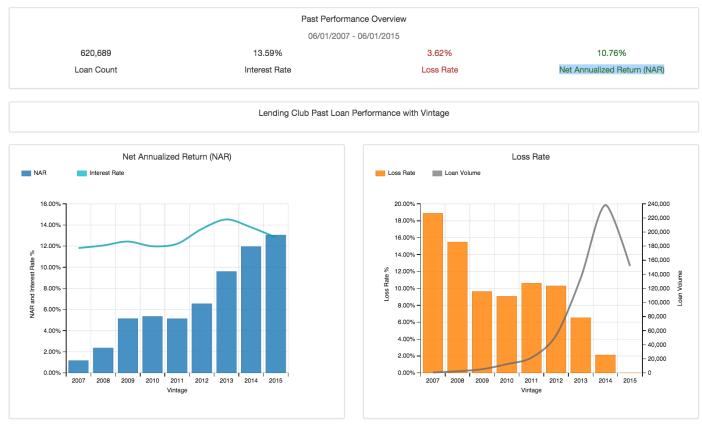

Source: Peercube

The chart above is yearly Net Annualized Returns with loss rate at Lending Club. More niche platforms such as Real estate crowdfunding platforms and Reamerge with secured debt has similar stable return profile with a strong downside protection (first position liens etc). How can this help level the retail investor portfolio volatility from the equities market is discussed below.

P2P/MarketPlace Lending Can help:

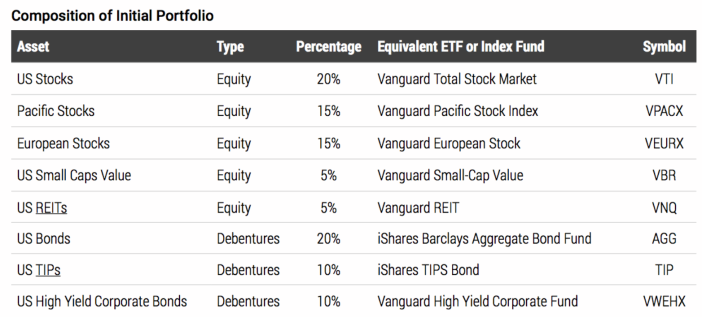

As industry’s first, LendingRobot has done an excellent analysis of including marketplace lending in one’s portfolio to smooth out the volatility. A quick highlight with screenshot from their PDF is below

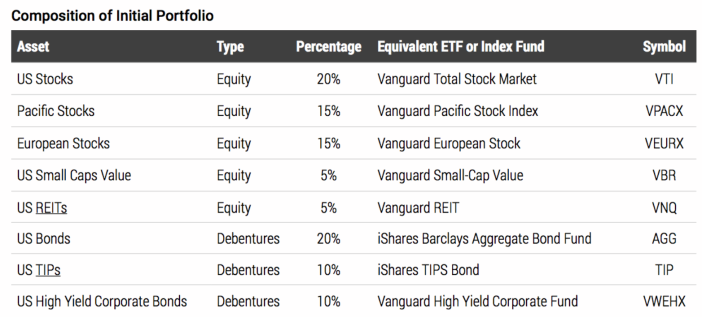

Beginning with a traditional portfolio of well diversified ETF stocks and bonds below

The average returns during 2005-2014 is 7% with volatility of ~40%

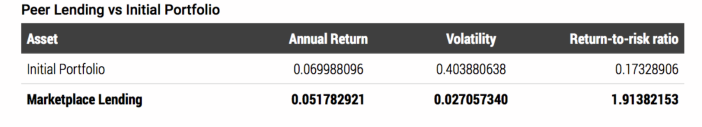

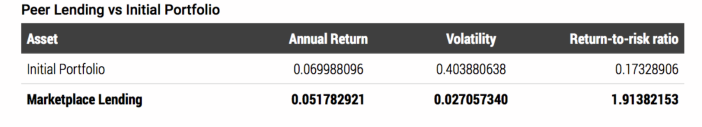

LendingRobot ran multivariate regression and their internal loan default rate predictions on LendingClub data to come up with the following head to head figures

What is striking about the figures is the super low volatility of Marketplace Lending.

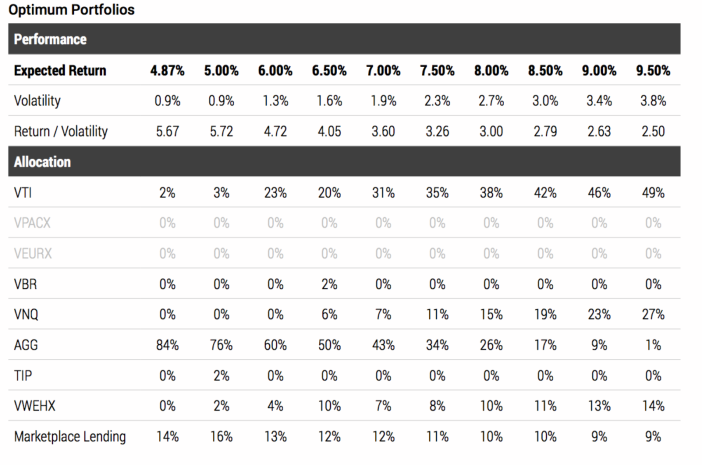

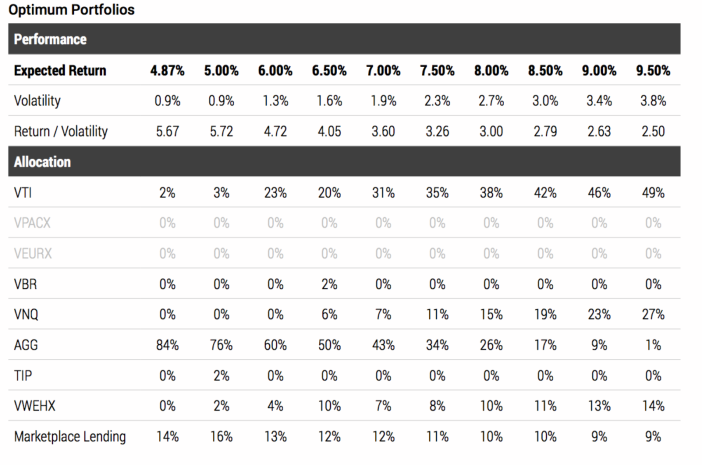

Finally, how much allocation should there be in market place lending? They came up with a fancy chart

With a minimum volatility of 0.9% you’d get an expected return of 4.87% – not bad. Alternatively a 7% return with a low volatility of 1.9% can be had with a 12% marketplace lending allocation (vs the traditional volatility of 40%!) These figures are likely even better if you have some allocation to niche platforms.

Full report can be seen HERE

Conclusion:

- Recent market turbulations, while not affecting long term investor, does raise questions: in the background of an overall negative market returns this year, global negative bond returns, can one consistently expect 7-8% returns while accepting the market volatility (risk premium)?

- Marketplace lending smooths out the volatility in the equities as an uncorrelated asset class while having a higher return than bonds.

- Niche platforms such as Real Estate, Business Lending (Reamerge) offer further diversification and thus further reducing volatility in one’s portfolio while realizing handsome uncorrelated returns.